Even after robots take over and humans cease to exist…

“eff around and find out” will survive.

BUSINESS. The long of the short of it

NFTs. 0% royalties, fire-breathing dragons & shoes

MEMES.

TWEETS.

BUSINESS. The long of the short of it

We suck.

We’re not good at calculating the lifetime value of things.

I wanted to bring a few things to light, so that you and I can make better decisions, the next time we’re faced with purchase, investment, relational, and health-related circumstances.

But before better decisions can happen, we must be aware of them.

I’ll be sprinkling concepts and examples in future issues, because if you’re like me and wear many different hats…you’ll digest this best in tiny doses.

CUSTOMER LIFETIME VALUE.

A customer at one of my restaurants - The Halal Guys - isn’t worth the $15 meal they paid earlier today.

They’re worth more. Way more.

An average customer of mine eats twice a month. If you multiply that by ten years, the value of this customer becomes $3,600.

Add the fact that they:

Sometimes bring friends (the $15 becomes $45-$50) or orders for the office ($150 for a ten-person team);

Order online through third-party delivery (add an extra purchase per month);

Order/refer catering opportunities once a year (an average catering order of ours is $250; and we have companies who order monthly); and

Rave about us to others, which brings one new customer, at least….

The calculation can be done in many different ways; but I’ve placed a lifetime value of $20,000 on that customer.

If our staff treats that average customer horribly, we lose more than $20,000 - most likely forever.

And we say “more than” because though a positive review may attract one more customer, a negative review will lose ten potential ones.

I’ll expand on this, even further.

Each customer supporting my stores will to help me build more stores (I currently own nine of them);

I get management fee revenue for running these stores on behalf of my investors;

This performance attracts consulting opportunities (I advise for other restaurant chain franchisees and founders - some who pay me fees of over six figures); and

There is also value selling my chain of stores for sale in the near future.

So yeah - I’m probably undervaluing each customer at $20,000, actually.

With this in mind, I’d better:

Be more careful about hiring the right people who interface with my customers. That the business adage “be slow to hire, quick to fire” shouldn’t just be a cliche, but should be put into religious practice.

Invest in delighting my workers, so that they delight my customers. It’s a trickle-down effect.

Invest in tools to help customers enjoy their experience better, and turn them into raving fans (raving fans multiples the metrics). And

Be less stingy about giving a $15 free meal to a wronged customer. We tend to fight for pennies, while we are losing dollars.

What about your work?

I encourage you to do a little bit of math on the lifetime value of the customers you serve.

How much revenue do your clients produce for you, spread out over a one-, five-, ten-year period?

Tack on the abilities to ask for referrals, upsell, the open new revenue centers, sell your company, etc.

It ultimately doesn’t matter how you calculate, but that you consider the butterfly effect of everything - and that means every thing - and to engineer every thing you do.

**********

What do you think?

Are there any other mindsets, behaviors, or actions that seem harmless or trivial, at first…but compound and translate into huge wins or costs?

NFTs. 0% royalties, fire-breathing dragons & shoes

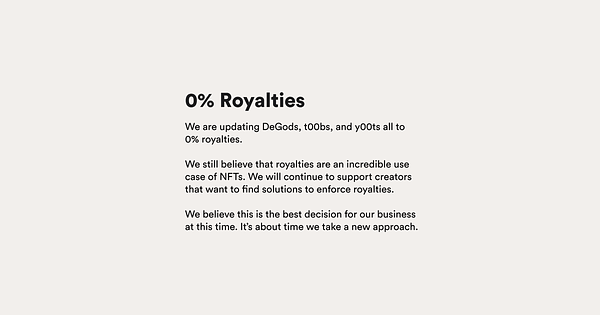

I currently own a y00ts tube NFT (currently at 118SOL = about $4,000USD); and it’s part of the DeGods ecosystem (currently at 318SOL = about $10,000USD).

Creator @frankdegods has been known to be prolific, brilliant, and innovative; and he recently posted this Tweet, which seemed to divide the NFT Twitter space:

I applaud this. But this is circumstantial, and will probably only work for projects like DeGods and y00ts.

Why?

They have amazing leadership;

They’ve already amassed a ton of money at mint;

They’ve already made a bulk of their royalties on the front end; and

They’ve also raised $7 million to beef up their operations.

They’re not hurting for money and they’re pretty diversified from the royalty well.

I don’t disagree with paying royalties. I mean, I’m in the franchise business; royalties are the lifeblood of my wealth.

I also don’t think they needed to go zero. 1-5% would’ve been perfectly fine and understandable. And if there’s anything I learn, good companies tend to leave money on the table, things usually cost more than expected, and cash flow runway matters.

But when @frankdegods posted this, I got super excited. I don’t believe he’d do this unless he had a more profitable way forward.

MFer is hiding alpha lol!

Royalties are a standard practice, aren’t as lucrative as one might think, and it’s subject to market sentiment versus true value.

I believe that, if you don’t lean on royalties, you’ll be forced to think and execute outside of the box.

Innovation and creativity happen in constraints.

What can they do? Any ideas?

I wonder if this post will age well lol! We’ll see! But I’d like to believe that they can build wealth by building actual, revenue-generating companies.

Having both the “I told you so” and “oh crap, I was wrong” cards at the ready.

In a previous issue, I mentioned my love for the artist @gengoyaclub, and have a few of his pieces, already.

He’s not only created art that delights and connects; but he’s also created immense value for me and the rest of the community - like get me access to an NFT that’s currently valued at almost $1,000USD (Critters Cult, with a floor price of 19SOL = $628USD), by an artist whom I am a massive fan of - @rgb0x00.

He recently dropped a new NFT, called Spicy Scared Scorching Dragon - and it’s the first collection I’ve seen him do with animals (but still has that amazing minimal Gengoya touch); and it’s giving me nostalgic Pokemon vibes.

He minted out before I got a chance to get involved; but I didn’t make that an excuse.

I bought mine for 6XTZ (under $9USD). You can get it off of secondary here (it just won’t be mine lol).

I just checked right now, and saw that the last sale was 7XTZ, and there’s one listed for 12XTZ.

Cool that there’s a bump in value; but I’m holding on to mine, because I got in so early, I love it, I wanna support kind and talented artists, and this is Gengoya’s first venture into animal style.

Okay, now I’m hungry for In-N-Out Burger…

A month ago, I bought a CryptoKicks NFT - which was a drop by RTFKT by and Nike - because there was no activity happening, lately (which is always a good time to buy; because when you hear about it and it’s pumping, you’re usually too late); and because the price hasn’t been that low.

I placed a WETH offer for .5ETH and it got accepted.

A month had passed, and I needed the liquidity to pursue something I felt was more valuable (I’ll be writing about my forming a DAO in a future issue).

I saw that the floor price was .52ETH, so I listed it and it got sold quickly.

Minus royalties and OpenSea fees, I pretty much evened out.

I made a joke about how, whenever I sell my NFTs, they tend to go up…

…and I was right lol!

I don’t feel regret, because the opportunity cost was in favor of me selling. But I’m glad my intuition about its growth was right, and it’s a reminder that - if you are liquid enough - be patient. It’s going to be your wealth-building super-power.

It also reminds me of a powerful investing quote by Warren Buffet:

The stock market is a device for transferring money from the impatient to the patient.

All of this is for entertainment/informational purposes only, okay? And all of these decisions were unique to me.

BUT if you’re open to it, let me know what NFTs you’ve gotten into, sold, and are looking at!

MEMES.

TWEETS.

Thanks for reading. I love writing, so this means a ton =)

The best way to show that my work matters?

Subscribe to my newsletter, if you haven’t already

Forward this to a friend you care about

Share any feedback you to make this better

I produce written content (ebooks, newsletters, fundraising proposals, sales pitches, etc.) for companies and individuals, and have sold over 1,000 investments and $25 million in startup fundraising. Reply and let’s brainstorm ideas about having my team repurpose your value to reach and serve more people. Even if we don’t work together, I just love the practice of ideation and the ideas are free.